Threat of mounting financial losses in electricity distribution on Indian economy and way forward

The Electricity Act, 2003 had been enacted in the backdrop of restructuring of debt of SEB's in FY 2002-03 by the central government after many of them defaulted on their payments to generators.

Extent of financial losses

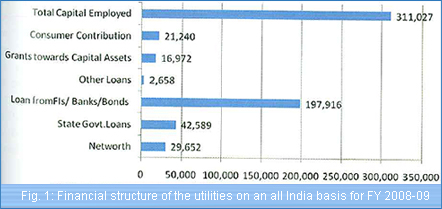

The losses in the electricity distribution sector had been growing without any respite. In 2001, financial losses of distribution utilities without subsidy were Rs 21,064 crores. In FY 2001-02, the financial losses without subsidy was Rs 20,623 crores. Even after enactment of the Electricity Act, 2003 the situation has not changed. The accumulated losses stood at Rs 39,444 crores in 2004-05, Rs 50,503 crores in 2007-08 and Rs 74,977 crores in 2008-09. Going by the current trend, the distribution utilities are projected to suffer a loss of over Rs 1.16 lakh crore by 2014-15, according to estimates by the Power Ministry. As per preliminary findings of V K Shunglu Committee on power sector, the total financial losses of power utilities in FY 2009-10 was Rs 40,000 crore~ and in FY 2010-11, it was Rs 70,000 crores. It is estimated that Rs one lakh crore have been raised as working capital by distribution of utilities to bridge the widening gap between realisation and expenses. The financial structure of the utilities on an all India basis for FY 2008-09 reveals a highly leveraged position with 77% of capital employed being financed by loans from Fls/Banks/Bonds and state government loans and net worth being only 9.5% of capital employed as is shown in Fig. 1. It is quite probable that the net worth has been wiped off by FY 2010-11 due to continued and increasing financial losses.

Reasons for continued financial losses

Mismatch between tariff and cost of supply

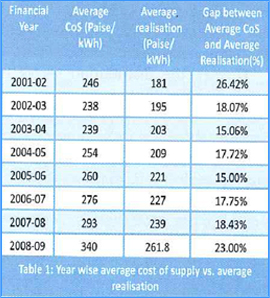

The reason for continued annual financial loss of a utility is simple. The average realization per unit of electricity sold is less than the average cost of supply (CoS) as is evident from Table 1.

It is also seen from the above table that although the gap between average CoS and average realization decreased in the period 2001-02 to 2003-04, it has increased every year from 2005-06.

Annual Revenue Requirement has actually increased substantially due to wage revision, accounting for unfunded pension liability, increase in interest and finance charges, etc. On the other hand, tariff increase has either not taken place or the increase has not kept pace with the rise in average CoS, increasing the financial losses.

Tariff revision not taking place annually

Tariff revision of states such as Tamil Nadu, Haryana, Rajasthan, Delhi, etc have not taken place annually, due to which there are large accumulated losses. For Tamil Nadu, there has been no tariff revision from 2003 to 2010. Annual Revenue Required in FY 2011 has been projected to be Rs 27946.44 crores against revenue from revised tariff of Rs 20041.04 crores leaving a gap after tariff revision of Rs 7905.4 crores. Accumulated loss up to FY 2009 is Rs 16500 crores. Losses of Rs 24,405.4 Crores have been converted into Regulatory Asset. The Tariff Order of TNEB issued in 2010 mentions, "With the continuing deficit of the Board, it is not possible to amortize the regulatory assets within the next 3 years as stipulated by the tariff policy. The regulated asset would further increase in the next two years as the trend of revenue gap continues. This issue can be addressed only in the long term" Similarly, due to non-revision of annual tariff in Delhi, the losses till FY 2009-10 of NDPL, BRPLand BYPL were Rsll12.64 crores, Rs 1679.57 crores and Rs 506.65 crores respectively. In 2011-12, NDPL, BRPL and BYPL are expected to incur losses of Rs 397.39 crores, Rs 617.63 crores and Rs 545.59 crores respectively.

Delayed subsidy payment and subsidy not being paid in full

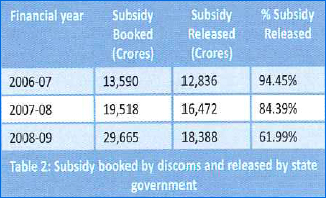

Subsidy committed by state government must be paid in time. However, from the table given below, it is evident that discoms are not being full extent of subsidy, due to which the discoms have to borrow at market rates which increases their financial losses. Also, it is seen that the trend of subsidy released each year as percent of subsidy booked is decreasing each year further, weakening the financial position of the utilities.

Trends in Consumption and Revenue

A look at the trend in consumer category wise consumption and revenue realization reveals interesting facts. It is to be noted that for 2008-09, while domestic & agriculture category consumption was around 45% of total consumption, revenue realization was only around 27% of total revenue realization. Commercial, industrial and others contributed to 55% of sales and revenue of 73%. With implementation of RGGVY, there will be steep rise in BPL consumption, low end rural domestic consumption as well as agri consumption whose average tariff is much below the cost of supply. Once a household gets electricity, his demand also increases. Even BPL consumers start using more light points, fans, TV's and heaters. The aspirations of the people have to be met. As such, increased electrification will require increased requirement of subsidy from government as well as cross subsidy from subsidising consumers.

Trends in the cost of Supply

Cost of supply (CoS) is increasing because of rising trend in cost of generation, O&M, interest cost, etc. Increase in cost of generation is due to rising costs of coal, oil and gas, requirement of import of expensive coal due to non-availability of indigenous coal, taking into account unfunded pension liabilities and wage revision. In 2010-11, average tariff rose by 6.5% while CoS increased by 16.5%.

Impact of losses on the Indian economy

The Indian economy is on a high growth path. This growth rate can only be sustained by higher growth rate in the power sector. The following section examines impact of high and continued financial losses in the power distribution sector on the Indian economy.

Impact on growth of power sector

India faced 10.3% energy deficit and 12.9% peak deficit in 2010-11. In order to bridge this gap, huge investment in power sector is required. Private sector is increasingly becoming wary of investment in -power generation as cash strapped discoms find it difficult to pay in time. This adversely affects the growth of new generation and specially private sector participation.

Further, the distribution sector is saddled with legacy network and obsolete technology. These networks are unreliable and needs strengthening. IT penetration is very poor. Integrated management information services catering to all the business process simply do not exist. There is hardly any SCADA systems. The average age of discom employees are high and there has been very little capacity building of employees, due to which their ability to handle modern computer based systems is low. Although, overstaffing is common, manpower productivity is low. Huge parts of rural India are still unelectrified. Due to weak financial position, much needed investments for modernization and expansion is not being carried out. The situation is clearly not sustainable. Discoms should be able to generate funds from internal accruals to fund its capital expenditure.

Poor health of utilities is also impacting its ability to ensure round the clock supply to all. As supply to low consuming domestic consumers; agriculture, BPL and rural consumers is below cost of supply it makes economic sense to discoms to resort to load shedding rather than to purchase more power. This has a cascading impact on quality of life as well as growth of the rural sector. Poor availability of electricity is one of contributing causes for migration of rural population to cities.

Impact on financial sector

No discom is having reserves in its balance sheet. Hence, the gap between revenue requirement and revenue collected has to finance through debt from external sources such as nationalized financial institutions or grants from government. Capital expenditure is mostly financed through debt. In view of continued and increasing financial loss, discoms may find it difficult to repay the loans. Financial stability of lending financial institutions is threatened. Nonperforming assets of financial institutions are bound to rise. Government bailouts of financial institutions will have to take place and this will have adverse effect the India growth story.

Impact on overall economy

Grants from government to finance losses of discom(s) reduce availability of funds for development. Poor financial health of discoms impair its ability provide secure, reliable and good quality power leading requirement of expensive backups which have higher carbon footprints. Poor quality of supply leads to burnouts of home appliance, use of voltage stabilsers and inverters all of which are energy inefficient.

Discoms do not want to supply electricity to loss making categories of consumers. This affects the development of rural sector and weaker sections of society due to which alienation of these sections of society is not uncommon. High industrial tariff is adversely impacting the competitive position Indian companies with respect to international players in domestic as well as international markets. This is bound to affect GDP growth.

Interventions required to make the distribution sector sustainable

In order to make distribution sector sustainable, it is essential that annual revenue from tariff should greater than annual revenue requirement. This requires a multipronged strategy involving government, Regulatory Commissions, discoms and consumers for reducing costs of operation and justified increase in tariff. The interventions required by different stakeholders are enumerated below:

Action by government

- Make any new generation coming up to be through competitive bidding only as this has resulted in much lower generation costs. It may be noted that 80% of the cost of power distribution is power purchase cost.

- Allow open access in letter and spirit in distribution (many state governments are putting impediments)

- Set up SLOC as per EA 2003

- Delink recruitment to top posts from government interventions and bring in tough, capable professionals

- Not put any overt/covert roadblock in annual tariff revision.

Action by Regulators

- Ensure annual tariff revision and reduction of cross subsidy as mandated by National Tariff Policy

- Ensure compliance to directions of commissions through monthly reviews

- Carry out consumer education/ awareness programs

- Ensure compliance to standards of performance

Action by discoms

- Strive for managerial excellence in all spheres of activity

- Carry out capacity building at all levels through well-crafted regular programs

- Any investment must fit in an overall strategy

- This can only be done by having a mandatory system of five year rolling plan subdivided into annual plans for modernisation, upgradation, manpower recruitment, capacity building, loss reduction strategies and targets, metering, consumer indexing, introduction of best practices including computerized MIS, SCADA systems, smart metering, smart grids, etc which include capital expenditure plans as well technical interventions. All central government schemes such as R- APDRP, RGGVY, etc must fit in the system plan of the discom. No central government scheme should be launched without a discom level system plan in place.

- Carry out activities as envisaged in Annual System Plan.

- Ensure energy accounting through 100% metering. All distribution transformers must be metered and linked though suitable communication system to remote computer systems. Prepaid metering should be aggressively promoted and popularized so as to reduce manpower requirement for billing and ensure revenue as per tariff slabs.

- Apart from manual bill payment system, every discom must have system for online bill payment and payment.

- Every discom must have well documented maintenance system suitably classified as per activity such as routine checkup, preventive maintenance, capital repairs along with schedule of carrying them out system for monitoring compliance. There must be a system for regular checking of all transformers in the field.

- Energy audit must be carried out as per Regulations of BEE.

- Have regular engagement with consumers and carry out consumer education/awareness programs.

- Ensure audited accounts within three months of financial year end as is being done for all listed companies.

- Have excellent complaint handling and consumer grievance handling system.

Conclusion

Surplus generation is the cornerstone for any financial sustainability as only then, can an organization achieve financial independence and the capacity to spend on capacity building of its human resources, carry out investments in modernisation, up gradation and system strengthening. Suitable tariff revisions must take place annually. Operational efficiency must be linked to tariff revisions to make it socially acceptable. Huge expenditure under various schemes such as R-APDRP, RGGVY can only yield result if an integrated system approach is taken where all investments are dovetailed to meet a common goal. As such, before any investment is undertaken, a discom level system plan clearly defining all interventions, capital outlays, sources of funding and execution details must be developed.