Energy security: Need for shale gas

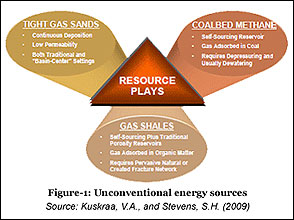

Access to affordable and sustainable supply of energy is pivotal for the sustained economic development of any country. In the past few years, affordability and reliability of supply from conventional sources of energy, in particular oil and natural gas, has been undermined owing to depleting reserves and increasing demand. This has resulted in increased focus towards development of 'unconventional' energy resources such as coal bed methane, tight gas, and shale gas (Figure-1). Shale gas is one of the most rapidly expanding unconventional gas resources.

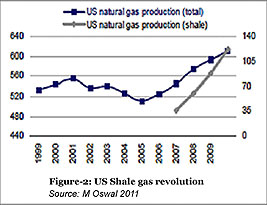

Shale gas has been on the global energy map since the 1950s, however, gained technical and economic accessibility only in the 1990s with advancements in technology in the United States. The technological breakthrough resulted in a sharp decline in the breakeven cost of shale gas which along with other factors such as surge in natural gas prices since 2000, deregulation of natural gas price, well developed pipeline infrastructure, well developed gas market, stable fiscal regime, easy leasing framework, and tax credits, has changed the US gas market scenario drastically (Figure-2). The US gas reserves estimates have increased from 30 to 100 years at current usage rate (Simon 2010) and the country has turned from a gas importer to a gas exporter. Following the success of USA, other countries including China, Canada, and Australia have initiated various processes to develop shale gas.

India too needs a focused approach towards development of this unconventional source given the inability of indigenous supply of natural gas to meet the growing domestic demand. As per the estimates by Deloitte, the demand of natural gas is expected to rise to 120 billion cubic meters per annum (BCM) by 2015 from the current 62 BCM per year. This along with limited domestic supply will result in increased import dependence and in turn an increased exposure to geo-political risks. Hence, it is imperative for the country to seek development of shale gas resources as it has a potential to contribute significantly to gas supply at a relatively lower price.

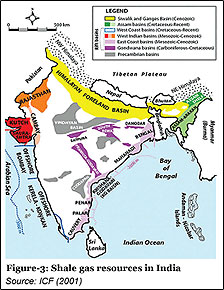

At present, India faces various constraints to the development of shale gas. One of them is the lack of exploration. A number of sedimentary basis (Gangetic plain, Gujarat, Rajasthan, Andhra Pradesh and other coastal areas) including the hydrocarbon bearing ones-Cambay, Assam-Arkana & Damodar are expected to hold large shale deposits (Figure-3)(which could compare well with that of the US). However, there are no definite assessments of the extractable quantity of shale gas resources in India. The reason for the lack of exploration could be attributed to the current exploration policy which does not allow oil companies to produce unconventional resources such as coal bed methane and shale gas from the exploration block. These are considered as 'unwarranted windfalls' and hence the production is forbidden. A separate bidding is required for these unconventional resources, thereby impeding exploration and production of shale gas in India.

In addition, shale gas extraction requires extensive drilling and hence the production process pollutes the air by volatile organic compounds, nitrogen oxides, particulate and other substances. The process also uses potential hazardous chemicals and its disposal may contaminate surface water and drinking water wells if not properly managed. Shale gas development also involves conjunctive use of resources such as land and water-the availability of both of which is a complex social and political issue in India.

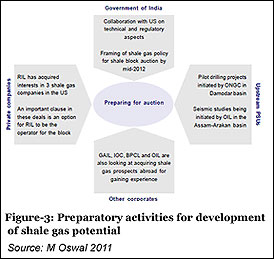

In the past few months, however, various attempts have been made to overcome the constraints and develop this unconventional gas resource to achieve greater energy security. Activities towards development of shale gas potential in the country have begun at an accelerating pace. These activities are marked by initiatives at the government level as well as among the oil & gas companies (Figure-3)

The Government of India (GoI), is planning to launch first ever auction of shale gas acreages for exploration by mid -2012. The upstream regulator, Directorate General of Hydrocarbons, is drafting an approach paper for shale gas exploitation in India. A robust shale gas policy is likely to be in place by the beginning of next year. GoI has also signed a MoU with the US government to help India in the characterization and assessment of shale gas resources, conduction of technical studies, training of manpower and framing of regulations for the implementation of India's proposed shale gas exploration program.

Various pilot studies have also been initiated to assess the economical availability of shale gas resources. OIL, for instance, has initiated projects in Assam-Arakan basin to evaluate economic feasibility of shale gas exploitation. ONGC has commissioned global technology major Schlumberger to carry out pilot projects in the Damodar basin to assess the availability and commerciality of shale gas.

Thus, given the geological potential of shale gas in India, the proposed regulatory amendments and introduction of facilitating policies, technical collaboration, and pilot projects, one can conclude that it will not take long for India to revolutionize its gas market and fully exploit the potential of shale gas resources in order to achieve greater energy security. What India needs to focus on, however, is the minimization of environmental hazards associated with production of shale gas in order to ensure sustainability of shale gas operations in India.