A burden on Planet

The government has been subsidising fuels to protect consumers from international price volatility and to make energy affordable in the economy. However, fuel subsidies, as vindicated by evaluation studies, have often failed to reach the intended beneficiaries. Undistorted pricing of fuels, along with an efficient delivery mechanism of subsidy, will meet the government objective and discourage any perverse incentives created for overuse of fuel, besides encouraging a shift towards cleaner sources of energy.

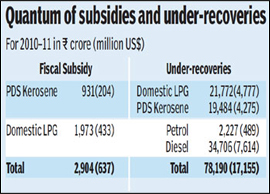

In India, subsidies are provided to consumers of sensitive petroleum products and electricity. Three sensitive petroleum products-kerosene, LPG and diesel-are sold below international market prices, with the government providing a fiscal subsidy on LPG and kerosene. The subsidy, however, covers only a part of the difference between the cost and the regulated price. This results in under-recoveries for the oil marketing companies (OMCs).

A large part of these under-recoveries is compensated through additional cash assistance from the government while another portion is covered by financial assistance from upstream national oil companies. The remaining portion remains uncompensated to the OMCs (see table).

The system for providing electricity subsidies is more complex. since policies and tariff rates on electricity differ among states and between consumer categories in each state. Moreover, state governments not only provide subsidies on tariff rates (by keeping tariff low) but also grant capital subsidies to the state utilities.

Inefficient subsidies on petroleum products and electricity burden fiscal accounts of the governments, incentivise diversion and misuse, and create barriers against private players from entering the market. A large number of petrol pumps owned by private players are currently sitting idle. Subsidies on fossil fuels discourage investment in cleaner forms of energy. Based on data from the International Energy Agency, phasing out consumption subsidies for fossil fuels between 2011 and 2020 would cut global carbon dioxide emissions by 5.8%.

Moreover, there are questions regarding how far these subsidies are benefitting the poor. A larger share of LPG subsidy is consumed by well-off households. According to an earlier study by TERI, 76% of the LPG subsidy goes to urban areas and nearly 40% of the subsidy is enjoyed by the wealthiest 6.75 % of the population. Almost 40% of the PDS kerosene is diverted to non-PDS and non-household usage (Ncaer). The provision of free electricity to the agriculture sector in some states has also led to overuse of ground water through tube-wells and agricultural pump sets, which has lowered the water tables.

However, poor households depend on subsidies to make energy affordable. For the households below the poverty line, expenditure on energy takes up a larger portion of their budget than it does for the wealthy. An increase in energy price and resultant inflation can put poor households under severe financial stress.

Subsidy reform can be designed in a way that minimises the negative impacts on poor households. A suite of policies have been used by countries around the world to ease the transition away from fuel subsidies.

A critical prerequisite is a high degree of awareness among people about issues surrounding subsidies. In this respect, TERI and the International Institute of Sustainable Development, published 'A Citizens' Guide to Energy Subsidies', explaining the scale and impacts of these subsidies. It is found that subsidies have a profound effect on the environments in which people live and the economies in which they earn their living.